Here’s how to improve your own cash flow management:

A business can’t survive without money. But how much does cash flow really impact a business, and what happens when that business runs into a cash flow problem? In the simplest of terms, cash flow is the amount of money that a business has, whether that money is being transferred in or out of the business. Managing that money can be a bit more complicated, requiring some helpful tools and tricks of the trade.

“Cash flow is the lifeblood of every business, and without a positive cash flow, the company can incur problems in operating the business,” said Bob Castaneda, director for Walden University’s MS in Accounting program. “Not paying some of the most important stakeholders in a company – such as employees, vendors or the IRS – can severely impact a company from doing business over the long term.”

Proper cash flow management is a key element of a healthy, growing business. This guide will explain the basics of cash flow management and offer advice on how to improve your business’s cash flow.

Why cash flow management is a crucial part of running a business

“Cash flow management is simple – think of it as the process of analyzing and monitoring the amount of cash you receive minus the cash you spend,” said Chris Terschluse, head of marketing and content at Chime. “A business’s ability to optimize its net cash flow is usually an indicator that a business’s overall financial health is strong.”

The opposite is also true. If cash flow becomes a problem, it can result in things such as late payroll and the inability to pay vendors or suppliers, which could lead to the deterioration of a business.

Negative cash flow can impact other areas, “such as reinvesting profits into growth opportunities or being able to properly staff their already-existing operations,” Terschluse said. “Studies show that most businesses fail due to poor cash flow management practices. Without keeping track of your cash flow, it’s easy to spend money you don’t have.”

Jenn Flynn, head of the Small Business Bank division at Capital One, said a recent Capital One study found that 42% of small business owners list cash flow management as a top concern.

“To get ahead of this, small business owners should consider developing a cash flow management plan,” she said. “This will help measure how much money is coming in and out every month. This process will also highlight any potential cash shortfalls and allow business owners to get ahead of issues that might arise in the future. Building a savings cushion can also help business owners prepare for unexpected expenses or future growth opportunities.”

Keeping your cash flow under control

Flynn emphasized that since effective cash flow management is essential to running a successful business, planning ahead can help you get there. Understanding your cash flow statements is also imperative.

“A cash flow statement summarizes money entering and leaving a company, detailing cash receipts (from sales) and cash expenditures (from expenses),” Flynn said. “These expenses include operating expenses like payroll, utilities, insurance, as well as taxes and loan repayments. If you are entering a growth phase, take the time to understand what you are going to need to support your business now and down the road. It’s important to realize that any cash flow challenges aren’t going to be fixed overnight with a loan. A financial forecast will help flush out the timing of cash flow needs.”

Castaneda said that a good enterprise resource planning system used in budgeting can help you capture and track payment commitments in the future by identifying when goods or services are ordered.

“Weekly and monthly cash flow budgets should be created and reviewed by management to understand the financial condition of the company,” he said. “Cash flow strategies can then be put into place, such as financing long-term assets or developing working capital commitments from vendors.”

Flynn also said that “understanding how much money is coming in and out every month, ensuring prompt payment from customers and vendors, paying bills on time, planning for the financial future, watching inventory, and various other factors” are key to better cash flow management.

“The best thing that a business owner can do is to understand the money coming and coming out, know their financials inside and out, and be diligent about saving extra funds for the unexpected. Additionally, we often recommend business owners consider opening a line of credit even when cash flow is positive, economic conditions are good, and interest rates are low,” Flynn said, adding that this can help bring peace of mind in case of a market downturn, sudden expenditure or even an unexpected growth opportunity.

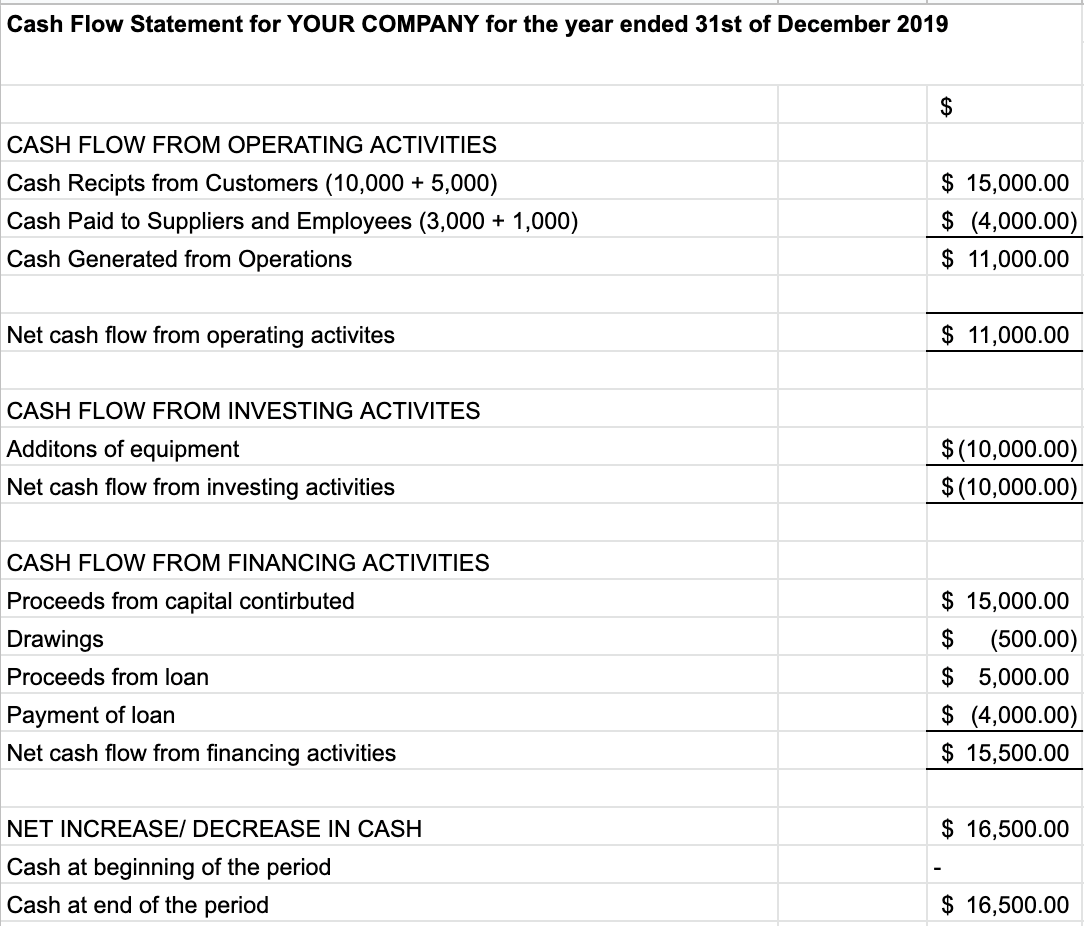

Cash flow statement example

Factors that can lead to cash flow problems

Cash flow issues are not reserved for seasonal or niche businesses. Even a business with the most “in” product or service can run into cash flow problems.

“Cash flow problems can be caused by a fundamental issues, like not having enough customers or clients, not charging enough for your services, or simply having too many expenses,” Flynn said.

But those aren’t the only things that can result in cash flow issues. Flynn added that they can also be the result of more nuanced or unexpected factors – “for example, a client who is chronically late in paying invoices, an unexpected tax bill or changes in minimum wage.”

Many of these problems present themselves in seasonal businesses, Terschluse added, because they tend to bring in most of their revenue during the summer or holiday season. But the leading cause of cash flow problems is low profits, losses, overspending and excessive customer credit.

“To avoid these, make sure your profit margins support and sustain total business operations, your stock meets the demand, and limit your customers’ credit or give them incentives to pay off their debts quickly,” Terschluse said.

Dewey Martin, professor emeritus at the Husson University School of Accounting, also noted that businesses that grow too fast often have cash flow problems.

“As a small business grows, it will have more cash tied up in accounts receivable and inventory,” he said. “Reducing the amount of accounts receivable or decreasing the amount of inventory a small business is holding can improve an organization’s cash flow.”

Cash flow management is a process, Martin said, and as part of this process, a company decides when to pay bills and estimates when it is likely to receive income.

“Good cash flow management requires companies to prepare a budget of projected receipts and disbursements,” Martin added. “Cash flow management is essential to the sound financial health of an organization. It is quite possible to have a profitable organization go out of business due to poor cash flow management.”

Article Source: https://www.business.com/articles/cash-flow-management-101/?fbclid=IwAR11qXGGN3bMiipAatapcPy9dRIB5FWXK1wqBgHLqjUGNzxAnP3EYenJRzc